You’ve done the hard work. You’ve stopped trading hours for money and started selling valuable, productized packages. But now, as clients from London to Lisbon are clicking “buy,” a new kind of dread sets in. You’re not just a freelancer anymore; you're a global business, and that means dealing with global sales tax, VAT, and a dozen other compliance headaches you never signed up for. If you're spending more time deciphering tax codes than delighting clients, it's time to stop just sending invoices and start building a real business machine.

Key Takeaways: Why an MoR Could Be Your Next Best Hire

- Automate Global Compliance: An MoR takes on the full legal responsibility for sales tax, VAT, and other local regulations, so you don't have to become a tax expert overnight.

- Simplify Your Finances: Instead of hundreds of individual transactions, you get a single, clean payout from the MoR, dramatically simplifying your bookkeeping.

- Reduce Administrative Overhead: Forget managing disputes, refunds, and failed payments. The MoR handles the entire customer payment lifecycle for you.

- Unlock True Scalability: With the back-end automated, you can focus 100% on growing your business, creating new products, and serving your clients—not on paperwork.

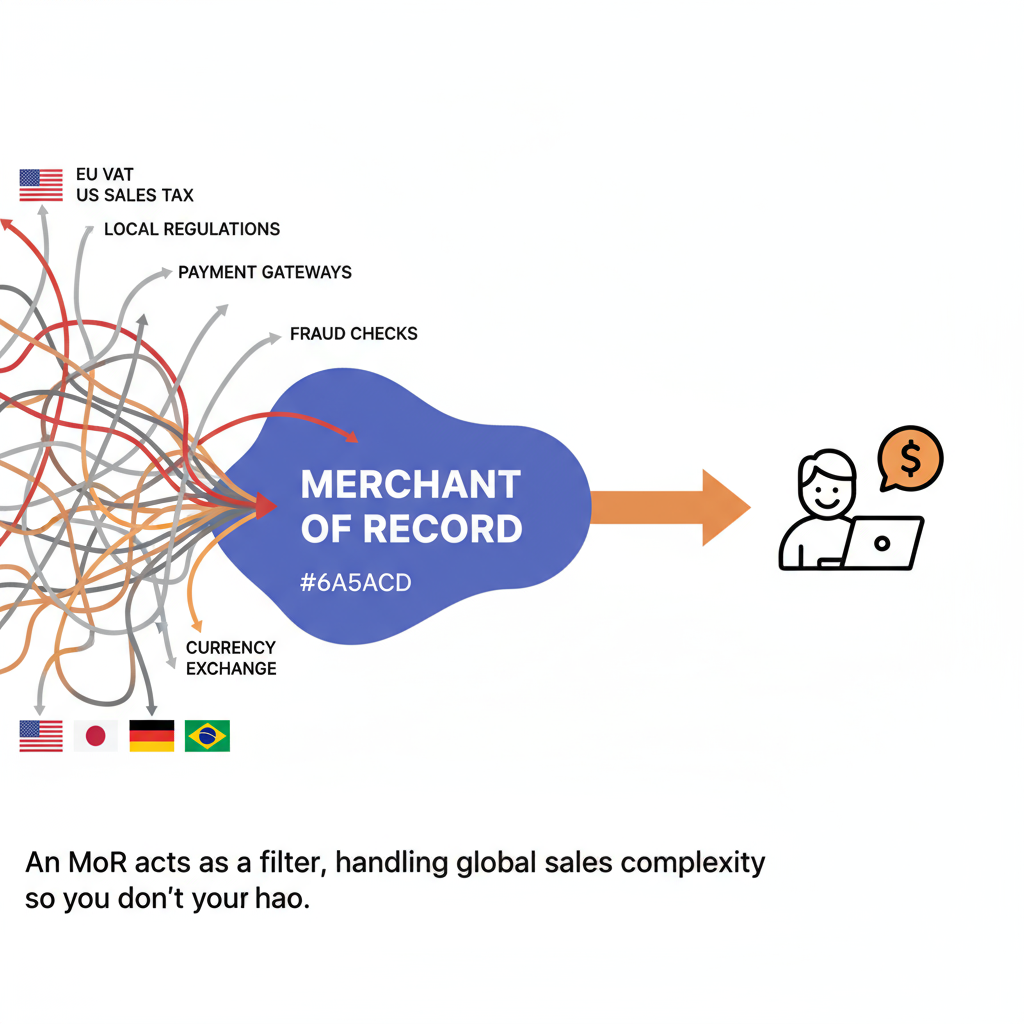

An MoR acts as a filter, handling global sales complexity so you don't have to.

An MoR acts as a filter, handling global sales complexity so you don't have to.

What Exactly Is a Merchant of Record (and How Is It Different from Stripe)?

Think of it this way: Stripe or PayPal are payment processors. They give you a pipe to collect money from a customer. That’s it. You are still the one legally selling to the customer, which means you are responsible for everything else: calculating sales tax, remitting it to the right governments, and handling disputes. It's your name on the invoice.

A Merchant of Record (MoR) is completely different. The MoR becomes the legal seller of your product or service *on your behalf*. When a customer buys from you, they are technically buying from the MoR. The MoR processes the payment, handles all the taxes and compliance, and then pays you out. It’s the difference between owning a food truck and having to get all the permits yourself versus selling your amazing tacos through a fully licensed restaurant that handles everything for you.

Before MoR: You sell a $100 digital product to a customer in Germany. You have to figure out the 19% German VAT, register with the EU, collect the €19, and remit it to the German government. A huge headache.

After MoR: You sell the same $100 product. The MoR (like Lemon Squeezy or Paddle) automatically adds the correct VAT, collects it, and handles all the remittance. You just get your payout, minus the MoR’s fee. Zero tax paperwork for you.

The MoR Tipping Point: A Checklist for Freelancers

So, when do you actually need one? An MoR charges a higher percentage per transaction than Stripe because it does so much more. The switch makes sense when the cost of your time and stress outweighs the higher fee. Let’s stress-test your business.

You might need an MoR if you check 3 or more of these boxes:

- [ ] You sell to customers in 3+ different countries.

- [ ] More than 20% of your revenue comes from one-off digital products (eBooks, templates, courses).

- [ ] You offer a subscription or retainer service with recurring billing.

- [ ] You spend more than 5 hours a month on financial admin (invoicing, chasing payments, bookkeeping).

- [ ] You plan to launch a new digital product to a global audience in the next 6 months.

- [ ] You have no idea what "economic nexus" or "VAT MOSS" means and don't want to learn.

- [ ] You want to present yourself as a polished, scalable business, not just a person for hire. Check out how a professional page can centralize this brand image.

Ready to Look Like a Scalable Business?

Before you can automate your sales, you need a professional hub that clearly outlines your productized packages. Use Livesume to build a professional services page that makes it easy for high-value clients to say ‘yes’.

From Solo Act to Business Machine: 3 Freelancer Scenarios

Let's see how this plays out for different types of freelance businesses. Where do you fit in?

1. The Freelance Consultant

The Business: Sells high-ticket project-based services and monthly retainers to a handful of clients, mostly in their home country. They use Stripe to send invoices.

MoR Verdict: Probably Not Yet. As long as the client base is small and geographically concentrated, the complexity is low. The higher fees of an MoR would cut into profits without solving a major pain point. A simple payment processor is fine.

2. The Digital Product Creator

The Business: Sells eBooks, Notion templates, or video courses to hundreds of customers all over the world. Sales are high-volume, low-price.

MoR Verdict: Absolutely Essential. This is the prime use case. Calculating sales tax for hundreds of transactions across dozens of countries and US states is a full-time job. An MoR like Gumroad or Lemon Squeezy is a no-brainer. It's the engine that allows this type of digital product business to exist.

For digital product creators, an MoR turns global sales chaos into streamlined revenue.

For digital product creators, an MoR turns global sales chaos into streamlined revenue.

3. The Hybrid Micro-Agency

The Business: Sells a mix of "done-for-you" services, productized packages, and a few digital products. Clients are international, and they're trying to scale.

MoR Verdict: Strong Contender. This is the tipping point. Managing subscriptions for productized services and handling one-off sales of digital products creates complexity. An MoR like Paddle can unify both revenue streams, handle recurring billing, and manage all the tax compliance, positioning the business for growth. This is how you escape the freelance marketplace and build a real AI-powered micro-agency.

Choosing Your Platform: A Quick Comparison

Not all MoRs are created equal. Here’s a quick rundown based on what you sell:

- For Digital Products & Subscriptions (The All-Rounder): Paddle and Lemon Squeezy are fantastic. They are built for software and digital goods, handle recurring payments beautifully, and provide great checkout experiences. Lemon Squeezy is often praised for its creator-friendly design.

- For Simple Digital Products (The Creator-Focused Choice): Gumroad is incredibly easy to set up and has a built-in audience. It’s an MoR that also acts as a marketplace. The fees are higher, but for getting started with zero friction, it’s a winner.

- For Client Services & Subscriptions (The New Wave): Platforms like Ruul are emerging to specifically serve freelancers, allowing you to run retainers and client invoices through an MoR model. They handle the B2B compliance so you can work with global enterprise clients easily.

Frequently Asked Questions About Merchants of Record

When do I truly need a Merchant of Record?

The moment you start dreading a sale because of where the customer is located. If the thought of selling to someone in the EU or another country gives you anxiety about taxes, it's time. Use the "Tipping Point Checklist" above—if you check 3 or more boxes, start researching MoR platforms.

How much does an MoR cost for a freelancer?

They typically charge a percentage of the transaction plus a flat fee. For example, 5% + 50¢. This is higher than Stripe's ~2.9% + 30¢, but it includes all the tax collection, remittance, and compliance services. The cost buys you time and peace of mind.

Can I use an MoR for client retainers and project-based services?

Yes, absolutely. Platforms like Paddle and newer, freelancer-focused MoRs like Ruul are designed for this. You can set up recurring subscriptions for retainers or send one-off invoices for project work, and the MoR will handle the compliance, making you look more professional to big corporate clients.

Is Gumroad a Merchant of Record?

Yes. This is one of Gumroad's most valuable and often overlooked features. They are the merchant, which is why they handle all the VAT and sales tax on your behalf. It's a huge benefit for creators selling simple digital products.

Do I need an MoR if I only sell to clients in my own country?

No, probably not. If your business is 100% domestic, the tax complexity is much lower and a standard payment processor like Stripe is likely more cost-effective. The primary value of an MoR is in simplifying international commerce.

What's the biggest downside of using a Merchant of Record?

The biggest downside is the cost—you will pay a higher transaction fee. The second is a slight loss of direct control; since the MoR is the legal seller, your relationship with payment gateways and your ability to customize the finer details of the payment process are mediated through them.

Turn Your Productized Service Into a Real Business

Choosing a Merchant of Record isn't just a financial decision; it's a strategic one. It's the moment you decide to build a system that can run without your constant manual input. It’s the final step in moving from a freelancer who invoices to a business owner who sells.

Here’s how to get started:

- Audit Your Revenue: Use the checklist above to score your business. Are you already past the tipping point?

- Map Your Packages: Clearly define what you sell. An MoR works best when you have clear, productized service tiers with set prices.

- Demo Two Platforms: Don't just read reviews. Sign up for a free account with two of the contenders (e.g., Lemon Squeezy and Paddle) and explore their dashboards. See which one feels more intuitive for your workflow.

- Plan the Switch: Pick a date to transition new clients or products to the MoR. You don't have to move everything overnight. Start with your next product launch and see how it feels.

By offloading the administrative burden, you free yourself up to do the one thing that actually grows your business: creating value for your clients.